Malta Company Formation: Your Guide to Success

Why Choose Malta for Your Business?

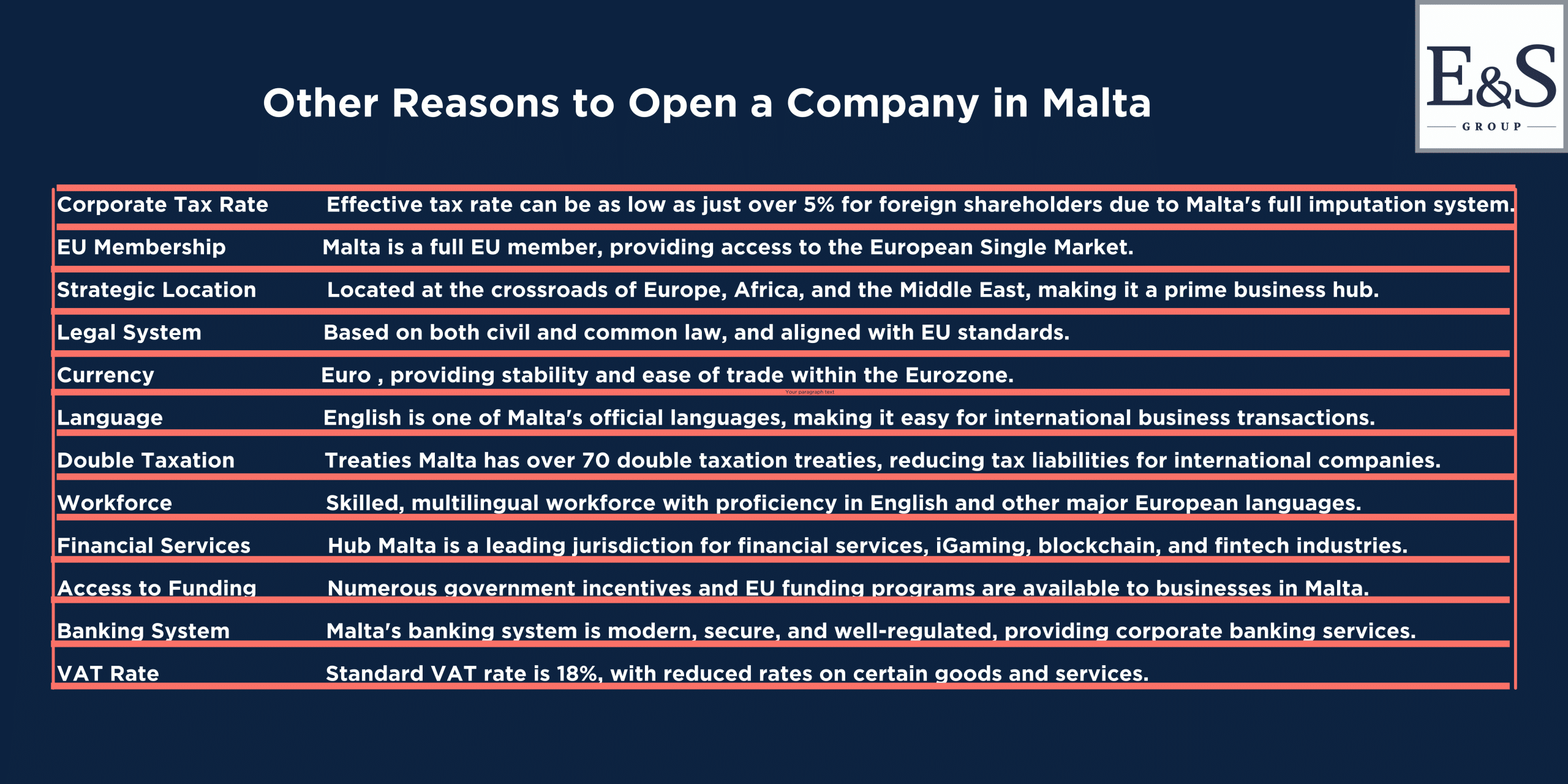

Malta offers an ideal environment for company formation, with attractive tax benefits, EU market access, and a straightforward regulatory landscape. At E&S Group, we provide expert guidance through every stage of setting up a company in Malta, ensuring compliance, efficiency, and maximized benefits for your business.

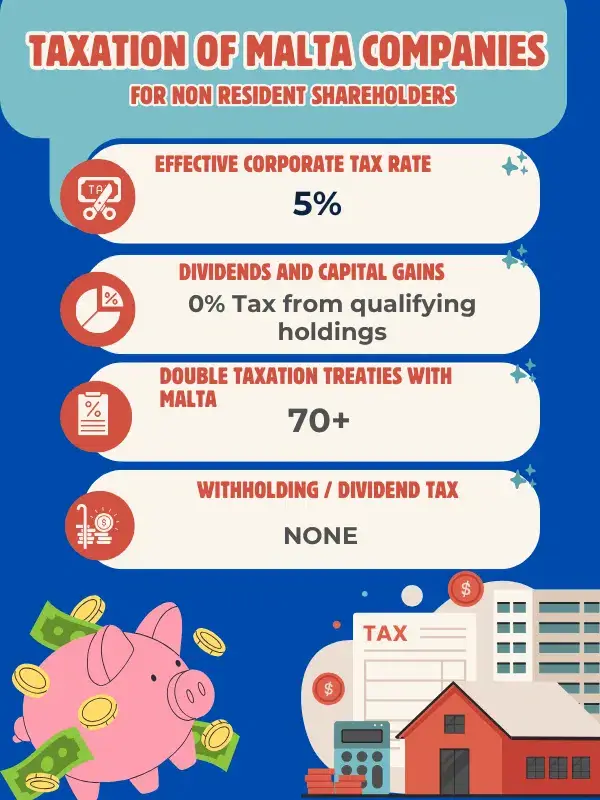

- Significant Tax Savings: Benefit from Malta’s effective corporate tax rate of 5% through tax refund mechanisms, leading to substantial savings for your business.

- Access to the European Union Market & Strategic Base for Expansion: Incorporate in Malta to gain unrestricted access to the EU market. Use your Malta Company as a gateway to expand your business across Europe while benefiting from EU laws and trade agreements.

- Expert Guidance from a Dedicated Team with 15+ Years of Experience: Leverage professional expertise in Malta company incorporation, backed by a proven track record of successful setups, ensuring compliance and the successful operation of your Malta company.

- Comprehensive Corporate Services: Receive end-to-end support—including company registration, legal advisory, tax planning, accounting, and compliance—tailored specifically to your business needs.

- Fast and Efficient Setup: Establish your Malta company in less than 3 days, ensuring quick operational readiness with minimal delays.

- Steps to Form a Company in Malta

- Types of Business Structures in Malta

- Specialized Company Types in Malta

- Share Capital Requirements

- Tax Benefits of Malta Company Formation

- Substance Requirements for Companies in Malta

- Corporate Governance and Compliance Requirements for Malta Companies

- Malta Company Bank Account Opening

- Ongoing Compliance and Annual Requirements

- Industry-Specific Information

- Costs of Setting up a Malta Company

- Our Company Incorporation Team

- Video explaining the advantages of Setting up a Company in Malta

- Frequently Asked Questions (FAQs) on Setting up a Company in Malta

Malta’s tax structure is one of the most competitive in the EU, offering unique advantages for businesses and investors alike. Here’s a closer look at why Malta is a top choice for tax-efficient company setups:

Malta’s tax structure is one of the most competitive in the EU, offering unique advantages for businesses and investors alike. Here’s a closer look at why Malta is a top choice for tax-efficient company setups: